top diversified emerging market mutual funds

Are you looking to invest in emerging markets and don't know where to start? It can be a tricky endeavor. With so many different funds available, it can be difficult to select one that fits your specific financial needs.

Whether you're just starting or are an experienced investor, understanding the fundamentals of investing in diversified emerging market mutual funds is essential for successful portfolio management.

In this blog post, we’ll explore some of the top diversified emerging market mutual funds currently on offer, discussing their various features, past performance, and risk factors involved with each fund.

What are diversified emerging market mutual funds and why should you invest in them?

Diversified emerging market mutual funds are funds that invest in multiple asset classes and securities, typically including stocks and bonds from countries with rapidly growing economies.

These diversified portfolios give investors access to top-performing assets in high-growth markets, such as China, India, Brazil, South Africa, and many more.

By investing in these top diversified emerging market mutual funds, you can benefit from higher returns, diversification of risk, and a smoother overall ride in the markets.

It's important to note that emerging market investments come with their own set of risks, including currency devaluation, political and social unrest, as well as macroeconomic instability.

To mitigate these potential risks, it is important to evaluate the top diversified emerging market mutual funds carefully, taking into account factors such as portfolio composition and track record. Additionally, regular monitoring of your investments is essential for long-term success.

How to research and select the best diversified emerging market mutual funds for your portfolio?

The first step to successfully investing in diversified emerging market mutual funds is to do your research. Consider the fund's track record and performance, its top holdings, management style, and investment objectives.

It can also be helpful to read up on the markets in which you are considering investing. You may want to leverage resources such as Bloomberg or The Wall Street Journal to gain insight into the top mutual funds in each emerging market.

Once you have identified a few top funds that fit your needs, review their fees, risk profile, and portfolio composition. Pay close attention to any hidden costs associated with the fund, such as load and exit fees.

When comparing different emerging market mutual funds, also consider the risk-reward ratio, as well as the fund's performance in both bull and bear markets.

The risks and rewards of investing in diversified emerging market mutual funds:

Investing in top diversified emerging market mutual funds can be a great way to diversify your portfolio and gain access to investments from new and rapidly growing markets.

While these types of investments can offer the potential for higher returns, they also come with a greater risk than many traditional investments. Before investing in any fund, it is important to understand the risk factors associated with it.

When selecting top diversified emerging market mutual funds, it is important to look beyond just the fund's past returns and take into account its portfolio composition, management fees, and track record of managing volatility.

To help minimize risk, investors should spread their investments across a variety of top-performing funds that meet their individual investment goals.

Top five diversified emerging market mutual funds to consider for your portfolio:

1. Vanguard Total World Stock ETF (VT): This exchange-traded fund gives investors access to a wide range of global stocks, including those in emerging markets. It has a low expense ratio and is one of the top diversified emerging market mutual funds available.

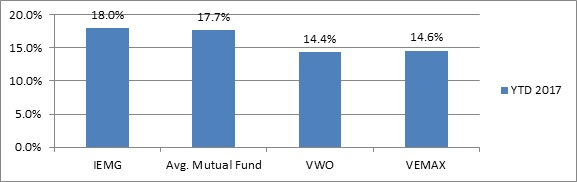

2. iShares Core MSCI Emerging Markets ETF (IEMG): This ETF tracks the performance of more than 800 publicly traded companies in emerging markets, giving investors access to a diversified portfolio. It is well-diversified and has a low expense ratio.

3. Vanguard FTSE Emerging Markets ETF (VWO): This fund gives access to

large and mid-cap stocks from 24 emerging markets, including China, India, Brazil, and South Korea among others. It has a low expense ratio and is well-diversified across multiple countries.

4. SPDR S&'P Emerging Markets ETF (EEM): This popular fund tracks the performance of an index comprised of more than 500 companies from 24 emerging markets. It is well-diversified and has a modest expense ratio.

5. BlackRock Emerging Markets Equity ETF (EME): This ETF tracks the performance of more than 650 companies from 20 emerging markets, including Brazil, Russia, India, and China. It is well-diversified across multiple countries and its expense ratio is low.

FAQs:

What is the most diversified mutual fund?

The top diversified emerging market mutual funds vary by individual goals and preferences, but generally include Vanguard FTSE Emerging Markets ETF, iShares Core MSCI Emerging Markets ETF, SPDR S&'P Emerging Markets ETF, Schwab Fundamental Emerging Markets Equity ETF, and WisdomTree Emerging Markets Equity Income Fund.

These funds offer exposure to a wide range of emerging market stocks, giving investors access to the top opportunities in this dynamic space.

What are the benefits of investing in diversified emerging markets mutual funds?

Diversified emerging markets mutual funds provide several advantages for investors. By having a portfolio comprised of multiple different countries and sectors, you can reduce risk by reducing your dependence on any one particular area. This can help to insulate your investments against downturns in specific economies or sectors.

Additionally, since emerging markets have higher expected returns than developed markets, investing in mutual funds that provide exposure to these regions can be an effective way to potentially increase returns.

What factors should I consider when choosing an emerging markets mutual fund?

When choosing top diversified emerging market mutual funds, there are several key factors to take into account. First, focus on the portfolio composition of the fund: what countries and sectors are included, what is the size and liquidity of holdings, and how much risk are you willing to assume? Second, investigate the fund's expense ratio: lower costs can lead to higher returns over time.

Conclusion:

Having a diversified portfolio is essential for mitigating risk and securing positive long-term returns, and emerging markets have themselves proven to be fantastic investment destinations. With the right diversified mutual fund choice investors can invest confidently while maximizing their returns in the realm of global investments.

The top diversified emerging market funds identified here represent some of the best options available, with a variety of fee structures, minimum investments, asset coverages, and potential returns. Careful consideration should be given to picking which fund will enact your investment strategy most appropriately.